cBroker

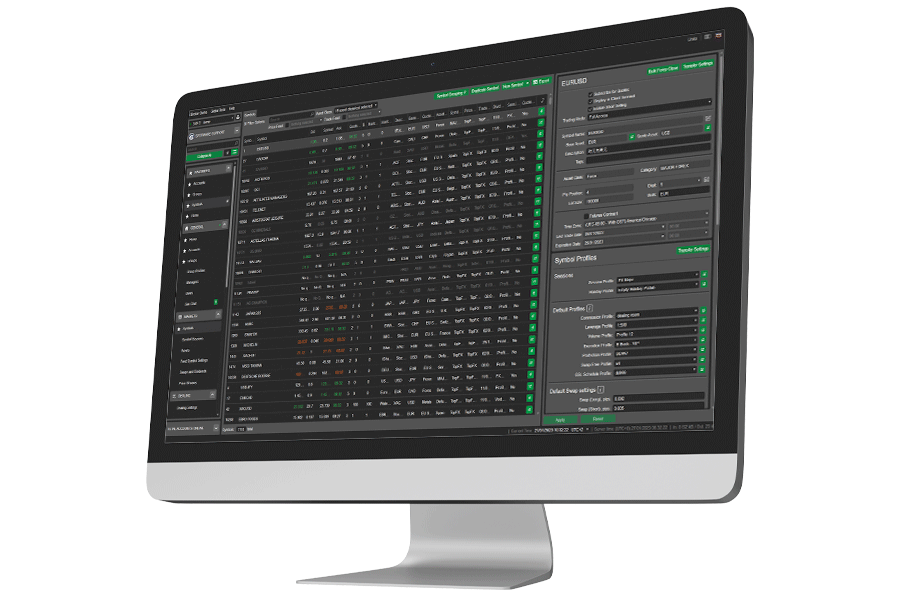

A comprehensive back office solution for brokers that allows them to manage accounts, generate reports about orders, deals, and positions, and configure the cTrader UI and UX.

About cBroker

cBroker is an effective and easy-to-use back office suite that contains all controls necessary for managing a trading server.

By using cBroker, managers can supervise nearly all aspects of traders’ activities. All essential features such as account management, the creation and setting up of new trading instruments, and risk management and reporting are available upon first-time installation and do not require add-ons or plugins.

cBroker is a premium business management solution relied on

by over 100+ brokers, so you can be certain that it has exactly what you need.

Benefits

cBroker offers the following benefits to brokers:

No-cost limitless operational scalability

cBroker supports the creation of an unlimited number of major server entities at no additional cost.

Precise management of trading parameters

cBroker allows for applying most major settings on a per-group, per-trading instrument and per-account basis. Brokers can create and apply highly customisable trading parameters for various segments of traders.

Flexible control over access rights

Different areas of cBroker and even individual UI controls can be disabled for certain managers via an easy-to-use managerial permission system.

Accelerated risk management process

cBroker supports a wide variety of risk management features including trade notifications for large orders and detailed reports that can be generated on a per-trader basis.

Key features

Built-in risk management mechanisms

cBroker offers a wide range of built-in risk management tools including customisable reports and real-time exposure statistics. Brokers can track all aspects of how, when and through which channels their traders place new orders, as well as how these orders are executed.

Flexible setup of trading instruments

Brokers can customise all major parameters that determine how certain instruments can be traded such as markup rates, swaps and dividends, volume calculations and commissions. Such settings are applied via group profiles, allowing brokers to create custom sets of rules that they can switch between when needed. Additionally, it is possible to create asset classes with no limitations; within an asset class, instruments can be grouped by custom categories.

Uploading and exporting data

When using cBroker, you can quickly and easily export and upload settings and entities to and from .CSV and .XLSX files. This facilitates migrating data between cBroker and any external solutions you may be using as well as managing key settings "in bulk".

White label management

In cBroker, you can easily restrict certain managers from seeing various white labels and all trading activity related to these brokerages. As a result, white-label resellers can be sure that their customers only have access to the data related to their respective businesses.

cTrader UI сonfiguration

Via cBroker, you can configure major aspects of the cTrader UI and UX including default chart appearances, custom account creation flows, startup actions and default deposit currencies. All of these settings can be easily applied on a per-white-label basis.

Transferring settings between servers

cBroker supports transferring certain entities and settings between trading servers, greatly improving the scalability of brokers’ operations. All cross-server settings transfer functionality is provided in the form of an easy-to-use wizard.

Tutorials

cBroker offers built-in help and documentation in the form of educational videos that explain how you can perform certain essential actions. As a result, you can be sure that managers will utilise cBroker to its full potential. Our educational materials should also help first-time users fully understand how cBroker works in a minimum amount of time.