cTrader spread betting

To address the needs of the UK brokers and their clients, cTrader supports multi-asset-class spread betting. It is available as a competitively-priced add-on to cTrader’s core product offering.

cTrader and spread betting

Spread betting in cTrader is a native, built-in feature used for a specific purpose. It is a low-cost add-on to the core cTrader package that can be offered alongside Forex and CFD hedging accounts.

Spread betting is compatible with your entire range of markets and orders are processed just like they would be for CFD trading accounts: using the same market data and liquidity providers.

Offer a tax-free alternative for UK residents to speculate on financial markets.

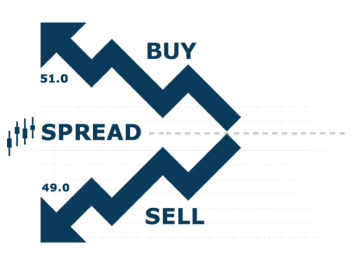

What is spread betting

Spread betting is not all that different from CFD trading. From a trader’s perspective, it is the way they enter the order that makes a change. Instead of choosing the volume of their order, they choose their stake, which is essentially the amount they want to win or lose per each pip that the market moves in or against their favour.

cTrader is the ultimate solution for banks and brokers to deliver

online trading platforms to their clients on any device.

Spread betting in cTrader

Spread betting in cTrader is an account type which means a trader can own both – CFD-trading and spread-betting accounts and switch between them in two clicks or taps, on desktop, web, iOS and Android versions of cTrader. Spread betting is also compatible with limited-risk accounts and guaranteed stop losses.

Settings for spread betting

Additional settings are available for managing spread betting arranged in a smart way to prevent any additional groups, symbols or special circumstances from being factored into your spread-betting offering. This is possible because cTrader group settings are designed to support all account variables possible, including spread betting.