cTrader

Latest updates of our fintech products, awards, interviews and & top-tier industry media publications.

How cTrader Empowers Traders to Avoid Scam Prop Firms

Feb 05, 2025

The prop trading industry has experienced considerable growth in recent years, offering traders the opportunity to trade large capital allocations in …

Spotware Concludes iFX Expo Dubai 2025 with Award for Best Trading Platform MEA

Jan 20, 2025

Spotware is proud to announce the resounding success of its participation at iFX Expo Dubai 2025. From engaging with industry leaders to showcasing ou…

cTrader 5.0 Now Comes with Free Algo Hosting and Cloud Execution for cBots

Dec 06, 2024

Spotware has rolled out the highly anticipated cTrader 5.0, which is now available to all cTrader brokers and prop firms. The update for Windows, Web,…

Meet cTrader for Mac

Dec 07, 2023

We at Spotware are delighted to announce that following thorough development, we are finally bringing you the most advanced cTrader product: cTrader f…

Let's meet at FMLS:23!

Nov 09, 2023

We're excited to announce that Spotware is gearing up for this event from November 20th to 22nd. Join us at the Finance Magnates London Summit to conn…

Spotware Shines in iFX EXPO's 2023 Ultimate Fintech Awards

Sep 27, 2023

In the highly competitive world of trading technologies, Spotware has once again proven itself as a market leader securing prestigious recognitions in…

cTrader Desktop 4.8 Unveils Overlay Indicators, Integrated IDEs for Algo Developers, and Backtesting and Market Replay Reports

Jul 12, 2023

The cTrader Desktop 4.8 release delivers overlay indicators, backtesting and market replay reports, integrated IDEs, the ability to run cBots in an ex…

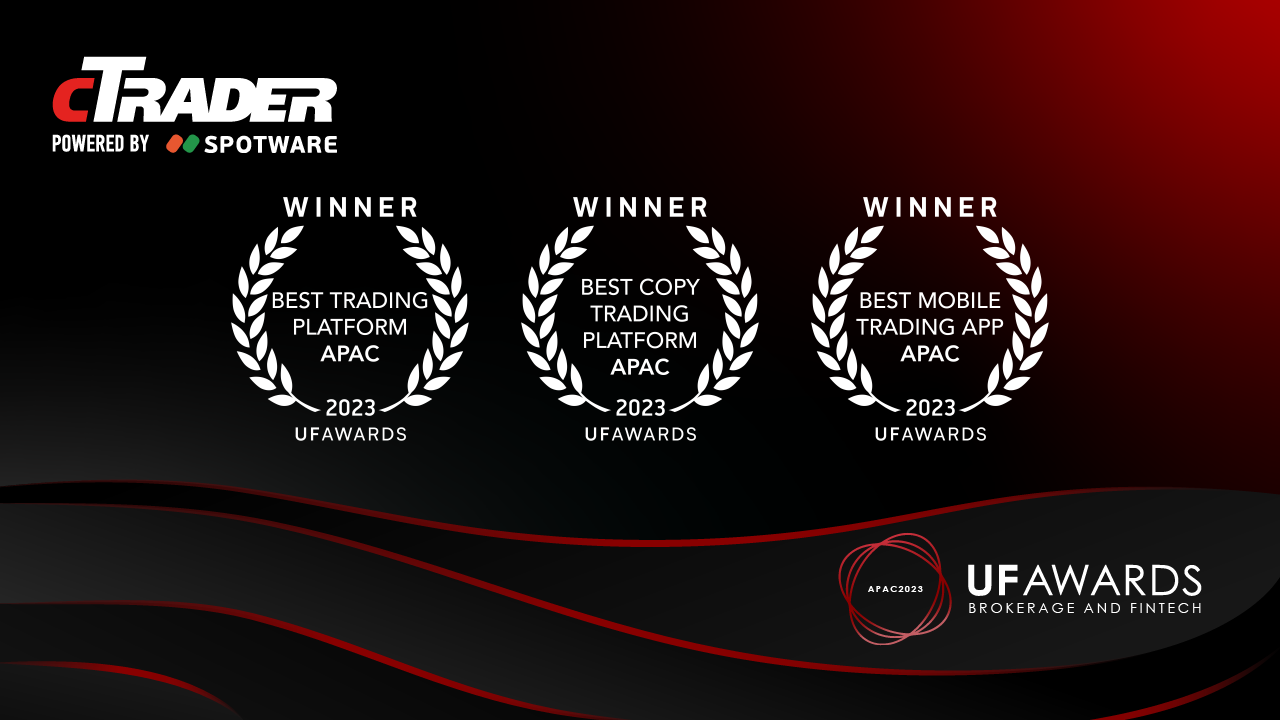

cTrader Wins Three Nominations at UF AWARDS APAC 2023

Jun 27, 2023

We are delighted to announce that the cTrader trading platform by Spotware has won several nominations at the UF AWARDS APAC in the rapidly evolving f…

cTrader Web 4.6 Comes with Advanced Link Sharing and User-flow Improvements in Copy

May 15, 2023

cTrader Web 4.6 release elevates shared trading experiences to a whole new level by allowing the sharing of trading signals (orders and positions), pr…

cTrader Mobile 4.7 Comes with Dark Theme for Android Users and Various cTrader Copy Improvements

Apr 28, 2023

The cTrader Mobile 4.7 version comes with the very appealing dark theme of the app for Android users. The version further offers multiple cTrader Copy…