Updates

Latest updates of our fintech products, awards, interviews and & top-tier industry media publications.

cTrader Adds PANDA CRM To Their Integration Ecosystem

Aug 03, 2022

We, at Spotware, are excited to announce the release of the integration of Spotware’s cTrader with Panda’s flagship CRM platform and Client Area. The …

cTrader Introduces Manager’s API for Brokers

May 18, 2022

The cServer team is happy to introduce a new Manager’s API for Brokers. Providing one of the most powerful tools for server-server integration, Manage…

cTrader Mobile 3.12 Offers Dark Theme & Apple Sign In for iOS

Jun 15, 2020

The new cTrader Mobile 3.12 release comes equipped with the much-requested Dark Theme on iOS, as well as with a “Sign in with Apple” option for quick …

cTrader Mobile 3.11 Features New Chart Types & Additional Improvements

Mar 23, 2020

cTrader Mobile 3.11 Features New Chart Types & Additional Improvements The new cTrader Mobile 3.11 release features the introduction of three high…

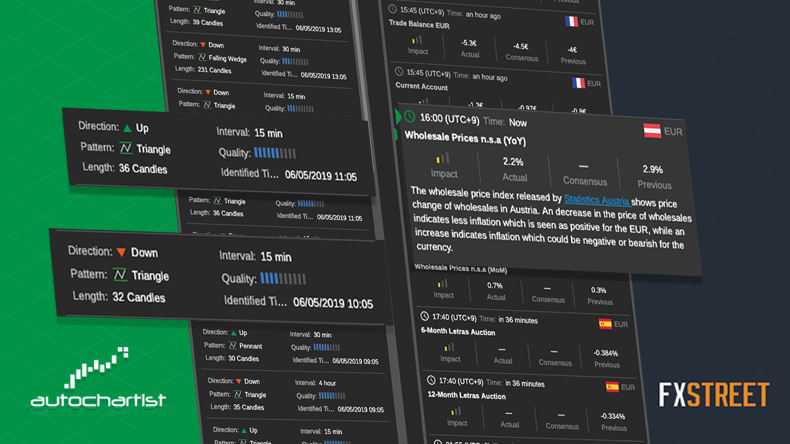

cTrader Web 3.3 Adds FXStreet Economic Calendar & Autochartist

May 27, 2019

cTrader Web’s update to version 3.3 marks a whole new step in trader experience. Aside from the additional features and convenience updates, technical…

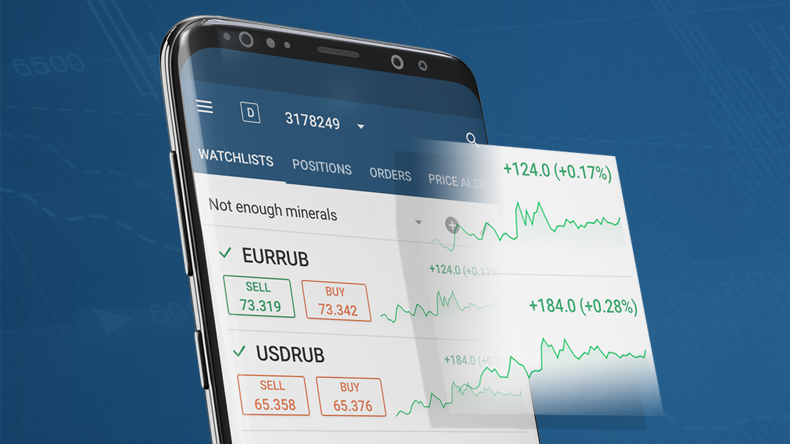

cTrader Mobile Gets New Features in Version 3.5

May 23, 2019

cTrader Mobile has been updated to version 3.5, comprising a series of trading experience improvements - from further customization options to improve…

Autochartist Market Analysis Added to cTrader Mobile

May 08, 2019

To provide traders with more information and functionality to help them make better trading decisions, we have integrated Autochartist Market Analysis…

Charge on Commissions Removed in cTrader Copy

May 06, 2019

In our aim to attract professional traders, offer better terms and improve the overall trading environment, we removed the 30% charge on commissions e…

cTrader Mobile 3.4 Introduces Sparkcharts

Apr 08, 2019

cTrader Mobile has become even more informative with the latest addition of Sparkcharts in version 3.4. Sparkcharts are charts located in Watchlist, t…

cTrader Mobile 3.3 Adds QuickTrade in Full-Screen Mode

Mar 18, 2019

In its aim to add more trading functionality to its platforms, cTrader Mobile has been updated to version 3.3 that allows traders to create orders in …